In order to support the monetary tightening process that started in June 2023, enhance the effectiveness of the monetary transmission mechanism and strengthen macro financial stability, the Central Bank of the Republic of Türkiye has adjusted the macroprudential policy framework to encourage Turkish lira deposits (Table 1). This blog post analyzes the impacts of the regulations announced on 20 August 2023 on deposit rates.

The new policy framework aims to gradually transition from FX-protected deposit accounts (KKM) and real persons’ FX-protected deposit accounts converted from FX (DDM) into Turkish lira deposit accounts, keep conversion to FX deposit accounts at a minimum level, and increase banks’ share of Turkish lira deposits. The total balance of KKM and DDM accounts, which had increased to TRY 3,408 billion by 18 August 2023, decreased by TRY 694 billion to TRY 2,714 billion in the period after the regulation until 1 December 2023, and the share of KKM and DDM accounts in total deposits dropped from 26.2% to 19.2% (Chart 1).

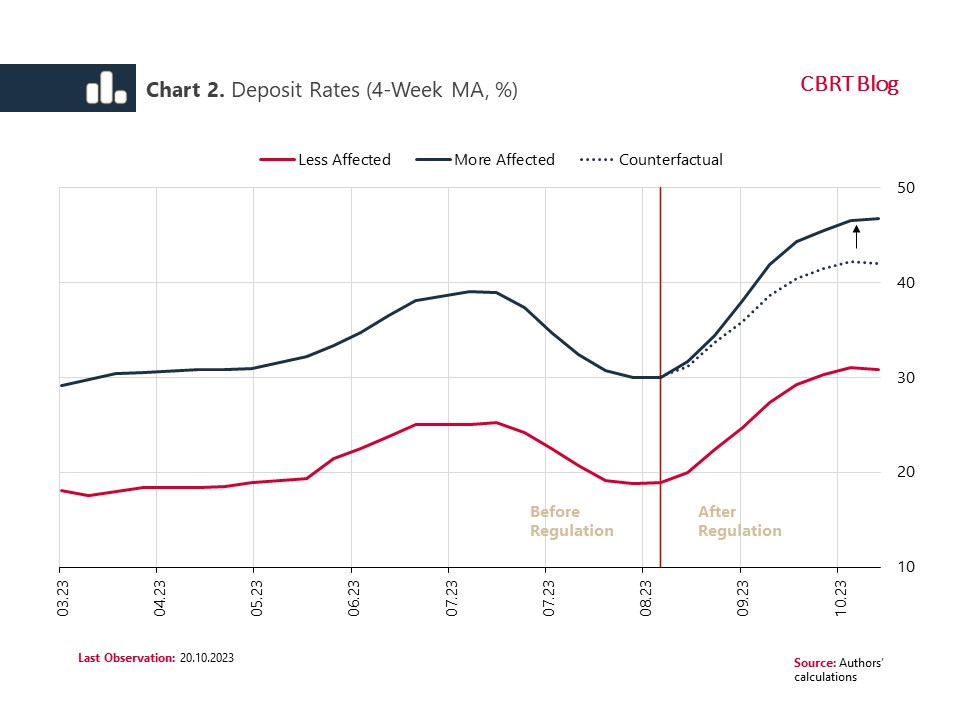

In the same period, Turkish lira deposit rates increased from 24.9% to 44%. Besides the monetary policy rate, deposit rates are also affected by liquidity conditions, expectations and macroprudential regulations. In order to reveal the causal effects of macroprudential regulations on deposit rates, this blog post presents a difference-in-differences analysis, in which the interest rates of banks that are more affected by the regulation are compared to those of less affected banks. Thus, the additional impact of the regulation on deposit rates can be measured.

This approach, which is based on regression analysis, examines the relationship between real persons’ Turkish lira bank level deposit rates and the KKM share showing the exposure of banks to the regulation.[1] A bank with more deposits that need to be converted into Turkish lira deposits due to its higher KKM share is expected to be more affected by the regulation and to make a higher increase in its Turkish lira deposit rates.

Chart 2 illustrates the impact analyses of the regulation. The "counterfactual" interest rate in the chart shows how the interest rates of the banks more affected by the regulation would have developed if the regulation had not been introduced and the interest rates of more and less affected banks had continued to move in tandem. After the regulation, the more affected banks have applied on average 2.5 percentage points higher interest rates to real persons’ Turkish lira deposits than banks that were less affected. Higher deposit interest payments by banks that are more affected by the regulation support the conversion of these banks' customers to TL deposits and increase deposit rates across the sector by an average of 3.4 percentage points.

For the reliability of the results based on the difference-in-differences analysis, it needs to be demonstrated that, after the regulation, interest rates of banks that are more affected by the regulation have differed from other banks in terms of timing, and that there was a parallel trend between the interest rate of the two groups before the regulation. To this end, the coefficients presented above are re-estimated as an event study (Chart 3). The course of the impact coefficients over time shows that interest rates of the more affected banks have increased and the differences from other banks have become statistically significant with the regulation. Therefore, the assumption of parallel trends, on which the difference-in-differences method relies, cannot be rejected for the selected confidence levels. [2]

To sum up, the impact of the regulations to reduce FX-protected accounts on pricing differs at the bank level. Higher deposit interest payments by banks that are more affected by the regulation support the conversion of these banks' customers to TL deposits. The results of the analysis suggest that the regulation introduced on August 20 has promoted the conversion of FX-protected deposits to Turkish lira deposits, thereby supporting macro financial stability, the monetary transmission mechanism, and the monetary tightening process that started in June.

[1] The analysis uses the interest rate for real persons’ Turkish lira deposits with a maturity over 32 days as the deposit interest rate. The KKM share is defined as the discrete and continuous values of the ratio of banks' pre-regulation (18 August) KKM balances to real persons’ Turkish lira deposits. In the discrete impact analysis, banks are divided into two groups based on the median value of their KKM shares, and their interest rates are compared. The impact of the regulation at the sectoral level is calculated via the continuous impact analysis. Regression models are estimated using data from deposit banks excluding participation banks for the period between 3 March and 20 October 2023, with bank and time fixed effects.

[2] The charts demonstrate the interaction coefficients, indicating the difference of more affected bank group in each month relative to other bank group and the base period of March and July, that are excluded from the estimation, as well as the 95% confidence intervals of these coefficients.