Balance of payments statistics cover all economic transactions of a country with non-residents. Reports prepared by banks, including the Central Bank, provide the primary data source for the compilation of Turkey's balance of payments statistics. Yet, besides bank reports, administrative data received from related sectors and data obtained from surveys are also commonly used to encompass all economic transactions in a precise and most accurate manner.

One of the principles of balance of payments compilation is the double-entry book-keeping system in which a transaction is recorded in two equal entries as debit and credit. To fulfill this principle, both entries of the transaction should be recorded at market value and simultaneously with the transfer of ownership. As a result of this book-keeping system, the sum of the "Current Account’’ and “Capital Account” items should be equal to the “Financial Account” item at all times.

However, this equivalence in theory is almost impossible to achieve in practice. The diversity of data sources causes variations in valuation and measurement as well as in time of recording. Consequently, the resulting differences are reflected in the Net Errors and Omissions (NEO) item as "residual". This item is obtained by deducting the current account and the capital account from the financial account.

Factors leading to the NEO can be categorized in three different headings:

Coverage: Transactions with non-residents may not all have been entirely covered by the data sources in use.

Valuation and Measurement: If different data sources are used for each corresponding entry of debit and credit for the same transaction, these data sources may measure this transaction in different amounts.

Time of Recording: Debit and credit entries obtained from different data sources for the same transaction may have been reported and thus recorded for different periods.

In this framework, the following factors come to the forefront:

- Incompleteness in the coverage of data for residents’ (excluding banks’) deposits in banks abroad in the Locational Banking Statistics released by the Bank for International Settlements (BIS),

- Failure to cover all countries, as only 46 countries report to the BIS,

- The fact that resident real and legal persons' deposits belonging to their affiliates, subsidiaries and branches abroad are considered deposits of the country they reside in and accordingly they are not included in the BIS' Turkey data,

- As transportation (freight) data regarding foreign trade are recorded according to the flag of the ship instead of the residency principle, the ships “in Turkish ownership but carrying the flag of a foreign country" are included in statistics as foreign transportation vehicles,

- Use of provisional data in place of data that are not available on the date of monthly publication.

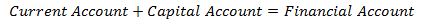

The NEO is affected by the foreign exchange legislation that changes over time, domestic economic developments, the course of the global economy, and the expectations and related behaviors of economic agents. For example, in line with the changes in the foreign exchange legislation, in particular the removal of the obligation to repatriate export proceeds increases residents’ deposits abroad. In periods when financial volatility is high, capital inflows are weak, the Turkish lira depreciates and tax / cash repatriation practices are in place, the share of capital movements originating from residents’ deposits abroad increases in the financing of the current account deficit (Chart 1). Moreover, in such periods, the foreign currency banknotes kept outside the financial system (under-the-mattress) could enter the banking system.

Balance of payments statistics and accordingly the NEO item can be revised as

- Monthly provisional data become finalized over time,

- Data start to be compiled from a new source, and

- A methodological change is introduced.

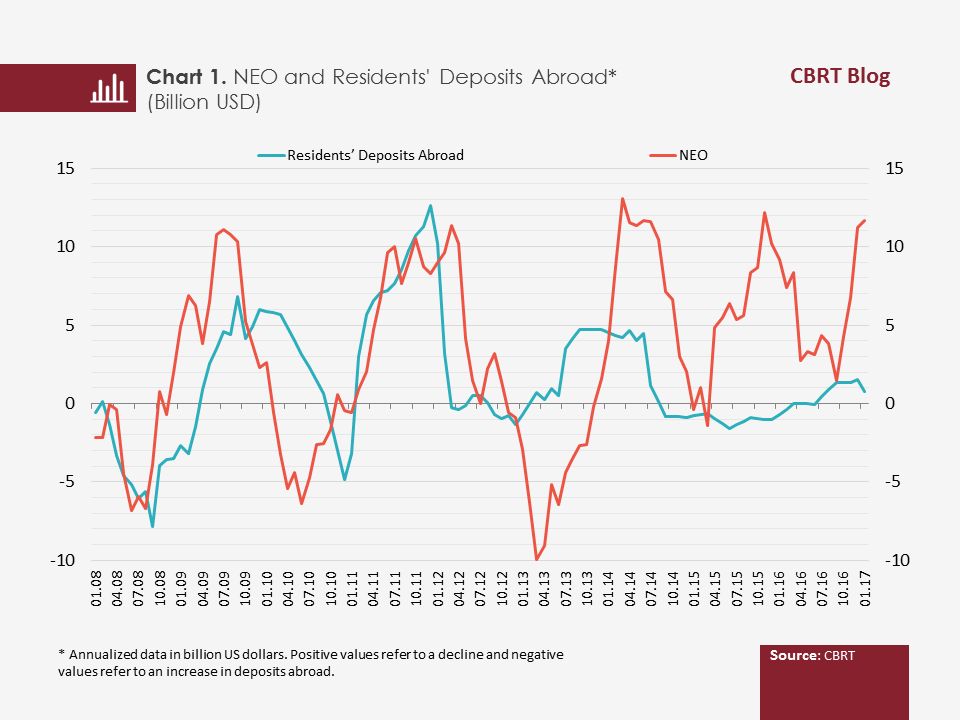

For instance, the NEO assumed a positive value of USD 8.4 billion in 2009 but declined to USD 2.3 billion in 2016 after the studies conducted in the following years. A similar pattern was observed in the subsequent years. An analysis of the years between 2009 and 2014 reveals that the NEO took high values when first published but dropped on average by 45 percent within two years and by 80 percent within four years as a result of the revisions (Chart 2).

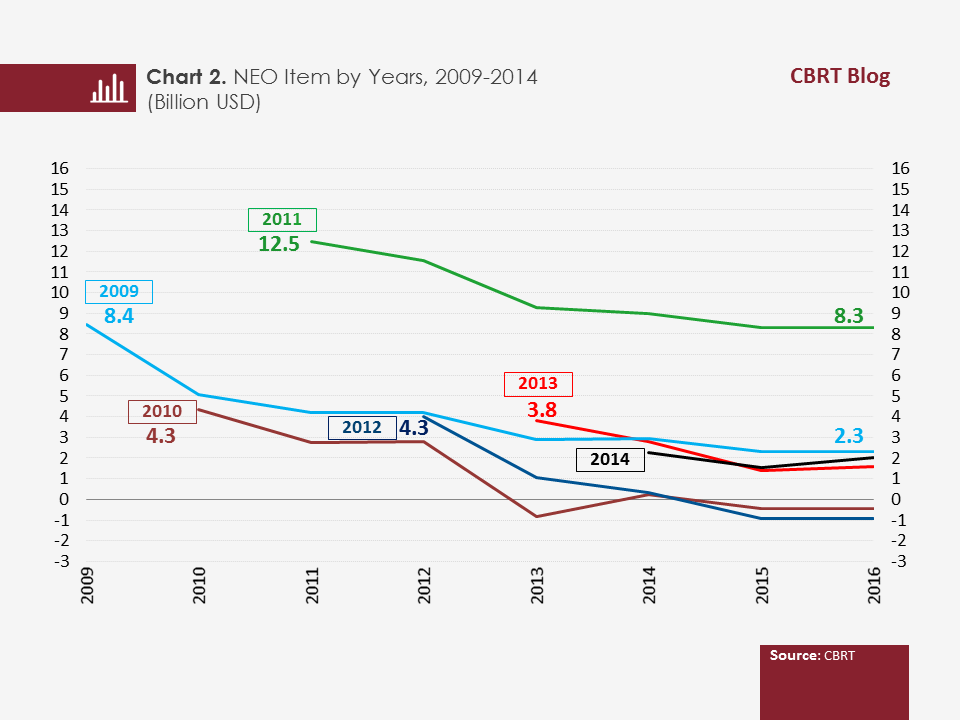

A comparison of the ratio of NEO to total FX revenues, which is used as a benchmark in international comparisons, with that of 20 selected countries suggests that the Turkey data moved within the range of minimum and maximum values on a stable track throughout the period under review.

To conclude, a significant portion of the NEO in recent years is believed to have originated from movements in residents’ deposits abroad. In addition, the NEO item is revised as provisional data become finalized over time, data start to be compiled from a new source, or a methodological change is introduced. Turkey’s NEO item hovers at reasonable levels compared to the averages of other countries.