In Turkey, a set of fiscal policy measures have been recently introduced to stimulate production, investment and employment and boost economic activity. The fiscal stimuli that were implemented in 2017 can be grouped under three main headings:

i) measures and incentives towards increasing employment,

ii) funding support (KOSGEB credits and credits guaranteed by the Credit Guarantee Fund-KGF) provided for small and medium scale enterprises,

iii) tax reductions introduced for housing (construction) and consumer durables sectors.

These implementations raise the issue of the effectiveness of fiscal stimuli.[1] This blog post discusses the effectiveness of recent fiscal measures in view of international academic literature and conditions idiosyncratic to Turkey.

The academic literature on the effectiveness of fiscal policy centers around two main questions: how and when does fiscal policy come into play? Consequently, in the first part of the analysis we discuss under which circumstances fiscal measures should step in for an effective implementation of fiscal policy and in the second part we discuss what kind of a policy/instrument design can enhance the effectiveness of fiscal policy. The recent fiscal measures are assessed with respect to these two aspects.

1. Under Which Circumstances Does Fiscal Policy Become Effective?

In his study, Buiter (2010) listed the following conditions necessary for expansionary fiscal policies to be effective:

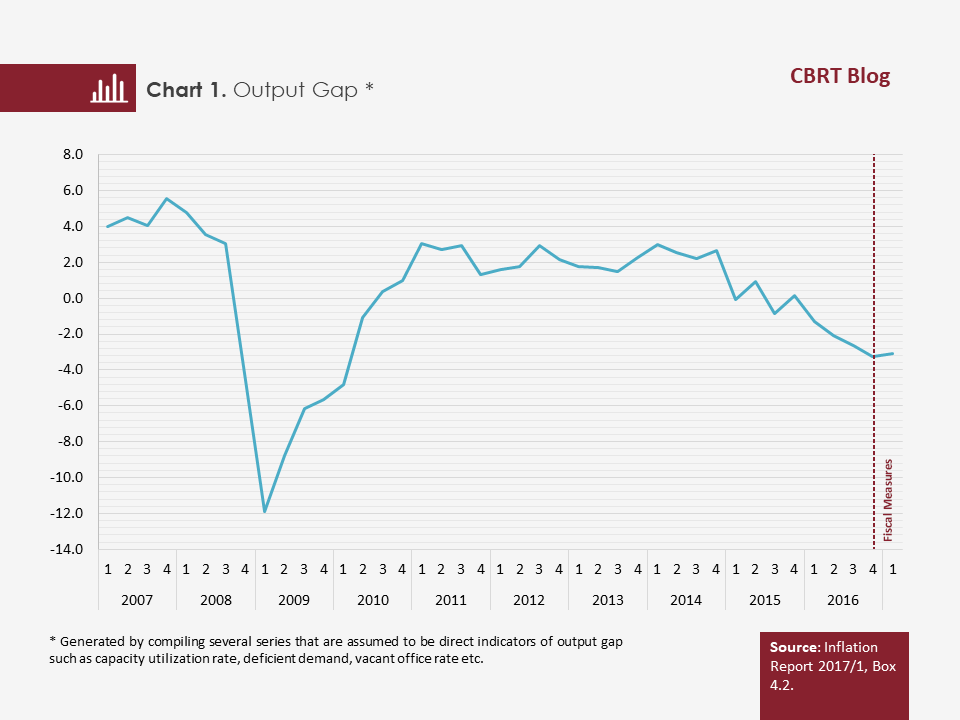

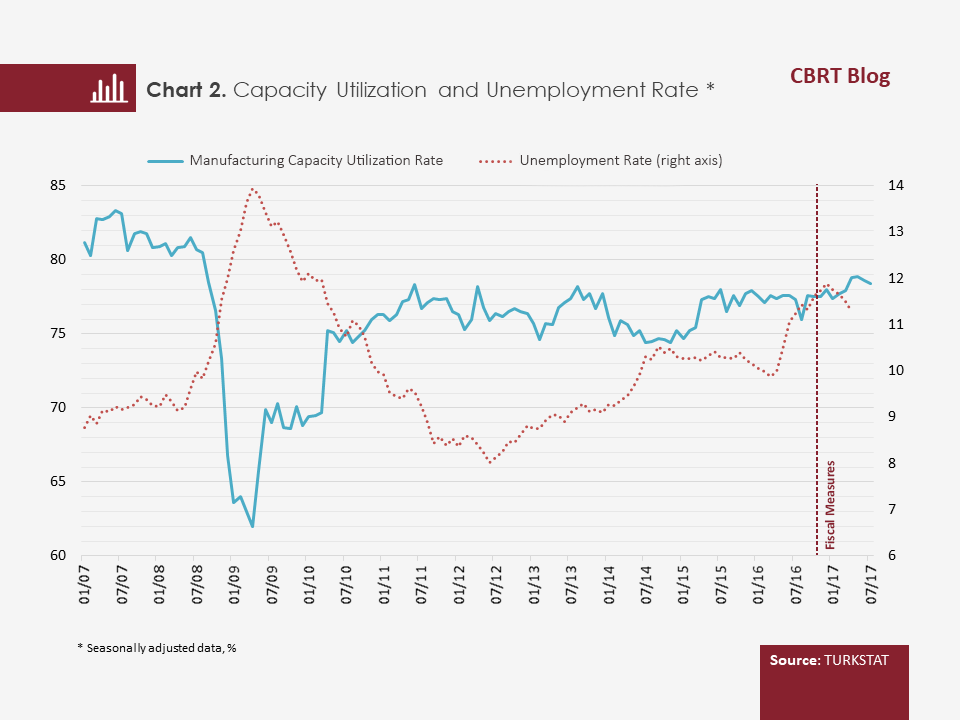

- Output should be lower than its potential (output gap should be negative), unemployment rate should be relatively high and capacity utilization rate should be relatively low.

- Monetary policy along with other policies are unable to be implemented in a counter-cyclical way due to a possible conflict with the primary objectives that these policies are given or due to the fact that their effectiveness in spurring economic activity is more limited than that of fiscal policy.

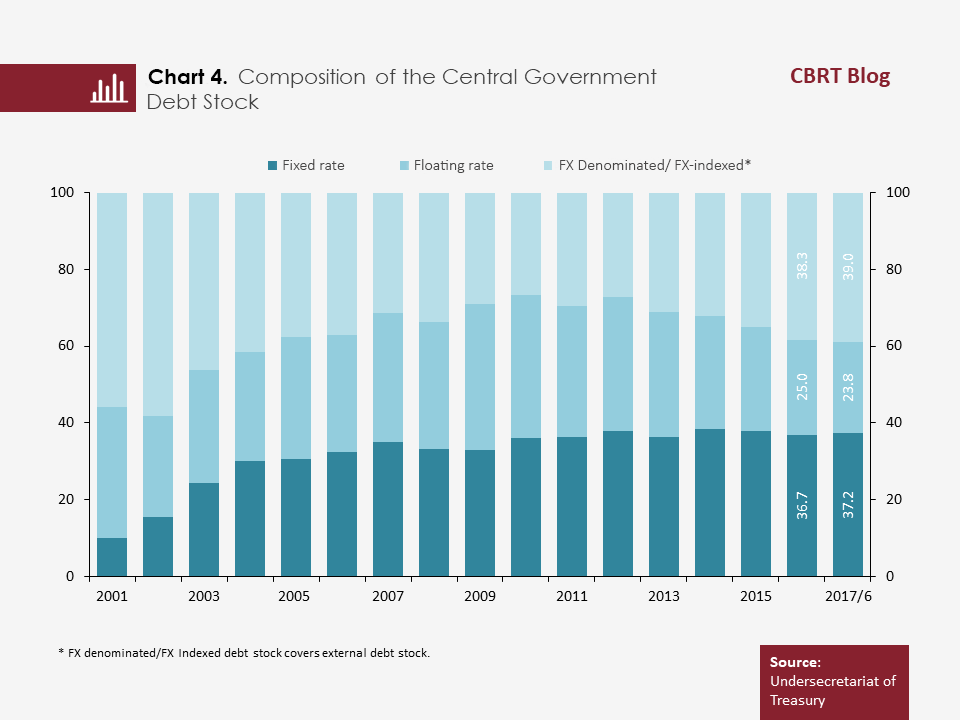

- Expansionary fiscal policy must not instigate a financial crowding out effect.

The first of the above-listed items points out that counter-cyclical policies would be more effective at times when production and employment are constrained by demand. In case of deficient demand, expansionary monetary policy is one of the policies that can be implemented, however, depending on the kind of shocks, in case of an economic slowdown coupled with rising inflation and inflation expectations, expansionary fiscal policies turn out to be a more feasible option. Nevertheless, for an expansionary fiscal policy to be effective there must be no complete financial crowding out and no complete direct crowding out. In cases where the ratio of debt stock to GDP is low and the maturity and composition of debt stock do not induce sensitivity to fluctuations in interest rates and exchange rates, the financial crowding out effect will be milder and thus, the expansionary fiscal policy will be more effective.

As for Turkey, all of the above-listed conditions necessary for an effective implementation of fiscal policy were satisfied by the final quarter of 2016. Several indicators confirm that the idle capacity had increased in this period (Chart 1 and 2). Expansionary fiscal policy measures were introduced to prevent the slow-down in economic activity and the contraction in credit supply from leading to a negative cycle. In addition, some mechanisms were put into practice to improve commercial credit guarantees and conditions and some expansionary macroprudential policies were introduced to revive consumer loans. The room for maneuver enabled by fiscal discipline over the last few years has allowed using fiscal policy without exerting a crowding-out effect (Chart 3 and 4). Actually, in the period immediately following the introduction of these policies, a significant improvement was observed both in credits and in economic activity.

2. What Are the Factors that Set the Effectiveness of Fiscal Policy?

The effectiveness of expansionary fiscal policy largely depends on policy design and on instrument choice besides the conditions mentioned above. The academic literature on this issue led by the studies of Elmendorf and Furman (2008), and Delong and Summers (2012) define four key criteria that a well-designed fiscal policy shall satisfy:

- Timely: For fiscal policy to be effective in stimulating the economy, it should come into play in a timely manner. Being late in detecting that a situation requires an expansionary fiscal policy stance or detecting the situation on time but failing to take the necessary measures on time would constrain the effectiveness of the fiscal policy on economic activity. Although forecasts pertaining to economic activity involve a considerable amount of uncertainty, introducing expansionary fiscal policy measures following a steady deterioration in indicators such as employment, non-performing loans and cash flows of firms for a certain period (for instance three months) is regarded as a timely action in academic literature. It can be asserted that the employment incentives, funding supports and tax reductions recently introduced in Turkey were timely as they were implemented before the slowdown in economy got deeper and improvement was observed right after they were introduced (Chart 1 and 2).

- Targeted: There are two criteria for a fiscal policy to be regarded as targeted. First, tax reductions, incentives and other public spending should be used in a way to generate the greatest impact on economic activity in the shortest time possible. Secondly, while designing policy instruments, priority should be given to sectors that are most severely affected by economic slowdown. Incentives for employing unemployed young people and those who have been unemployed for the last three months and the increase in the limits of loans guaranteed by the Credit Guarantee Fund for SMEs that have difficulty in access to credits due to collateral problems are examples of targeted fiscal policies.

- Temporary: The instruments that are used by the fiscal policy to revive the economy become more effective when they are implemented temporarily. Temporality of fiscal policy measures will ensure that the increase in budget deficit will not be permanent in the medium and short run and will prevent emergence of any financial crowding out. The recent fiscal measures in Turkey qualify for the temporality condition as they are implemented for a specified period. For instance, the incentives provided in the framework of additional employment program will be effective between February and December 2017 and the upper limit of the KGF guaranteed loans is TL 200 billion, showing that the measures will be temporary and limited. It was announced that the tax reductions introduced in early 2017 to propel economic activity would be implemented for a limited period of time. As another temporary support implementation, the social security premium payments due 2017Q1 were postponed to the final quarter of 2017.

- Choosing the instruments that will cause the lowest cost burden on the budget: In addition to the criteria mentioned above, it is frequently reiterated in the academic literature that a well-designed fiscal policy should be designed in a way to observe budget balances. This issue has been address in detail below.

3. How Can Fiscal Policy Be Designed to Preserve Budget Balance?

Delong and Summers (2012) argue that in a slowing economy, the degree of effectiveness of the fiscal policy heavily depends on satisfying two criteria at the same time: increasing economic growth in a short time and preventing debt stock dynamics from deteriorating.

The analytical framework below explains how these two criteria will be met. In the equations, Gt denotes public spending, Tt tax revenues, and Yt Gross Domestic Product (GDP). Let us assume that in an economy that has recently started to slow down or has already contracted, public spending increases by ΔGt in the next quarter.

The size of the contribution from public spending to growth (ΔYt ) will be determined according to the fiscal multiplier (µ):

The bigger the fiscal multiplier, the more the change in public spending contributes to the level of GDP. A fiscal multiplier smaller than 1 denotes that public spending crowds out private spending and makes a negative contribution to domestic product; a fiscal multiplier bigger than 1 denotes that public spending increases domestic product more than the rise in spending .

When the rise in public spending contributes to growth positively, tax revenues increase by an amount as much as the effective tax rate (τ):

The effective tax rate reflects the tax revenue generating capacity of the additional growth created by public spending. The higher this potential (the higher τ) the higher will be the rise in tax revenues. When we insert the value in equation (2) in ΔYt in equation (3), one unit of increase in expenditures induces τµ units of increase in tax revenues:

In this case, the unfavorable impact of increased public expenditures on the budget deficit (BAt) may be restricted depending on the rate of increase in the tax revenues after a recovery in the economy:

To sum up, for the fiscal policy to positively contribute to growth in the short term without deteriorating the budget balance and debt stock, the fiscal multiplier and the effective tax rate should be high. The fiscal multiplier assumes bigger values when economic activity slows down and fiscal position is strong; it weakens when uncertainty and the private sector indebtedness ratio are high.[2] If fiscal policy directly targets the sectors that are most severely affected by the economic slowdown, fiscal multiplier as well as the effective tax ratio will be higher. For instance, the funding support provided for SMEs via KGF is expected to stimulate several tax items such as the Banking and Insurance Transaction Tax (BSMV), corporate taxes and indirect taxes. Similarly, the employment incentives have a significant potential to create tax revenues taking into account the fact that employed people have a high marginal propensity to consume.

Accordingly, the timely, targeted and temporary fiscal measures such as funding support and employment incentives have a high multiplier effect and a significant potential for creating tax revenues, which is expected to limit the impact of these measures on the budget deficit to some extent.

[1] Çebi and Özdemir (2016), Özlale and Yüksel (2016), Huidrom et. al (2016), Alloza (2014), Krugman and Eggertson (2011). In their analysis on Turkey, Çebi and Özdemir (2016) and Özlale and Yüksel (2016) have found that the fiscal multiplier is around 2 despite differences due to economic cycle.

[2] What we mean by the effectiveness of fiscal policies is the degree to which fiscal stimuli affect economic activity.

References:

Alloza, M. (2014). “Is fiscal policy more effective in uncertain times or during recessions?” University of London.

Buiter, W. H. (2010). “The limits to fiscal stimulus”. Oxford Review of Economic Policy, 26(1), 48-70.

Çebi, C. and K.A. Özdemir (2016), “Cyclical Variation of Fiscal Multiplier in Turkey”, CBRT Working Paper, 16/19.

DeLong, J. B., and Summers, L. H. (2012). “Fiscal policy in a depressed economy”, Brookings Papers on Economic Activity.

Elmendorf, D. W., & Furman, J. (2008). “If, when, how: A primer on fiscal stimulus”, Hamilton The Project Paper

Huidrom, R., Kose, M.A., Lim, J. and F. Ohnsorge (2016), “Do Fiscal Multipliers Depend on Fiscal Positions?”, CEPR Discussion Paper, DP11346.

Krugman, P., & Eggertsson, G. B. (2011).”Debt, Deleveraging and the Liquidity Trap”. In 2011 Meeting Papers (No. 1166). Society for Economic Dynamics

Ozlale, U. and Yuksel, M.K (2016). "Budget Expenditures in Turkey: Impact of Various Dsitributions on Growth- available only in Turkish)" Koç University-TUSIAD Economic Research Forum Working Papers. No. 1603. Koc University-TUSIAD Economic Research Forum.